Check GST rates registration returns certification and latest news on GST. But there are some cases where ITC is blocked so that recipient is not able to claim ITC.

What Is Last Date Of Taking Input Tax Credit In Gst Input Tax Credit

Ineligible Input Tax Credit ITC Under GST.

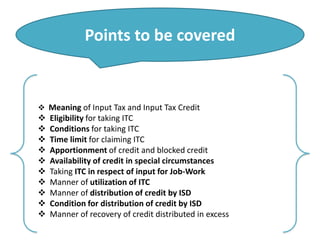

. Criteria for levying HSN code. Apportionment of credit and blocked credits. Rs 18 in this case.

You will have to deposit a flat under this category. Taking input tax credit in respect of inputs and capital goods sent for job work. Before implementation of Goods and Service Tax GST service tax was charged at the rate of 15 on most of the Insurance plans whereas now GST is charged at the rate of 18 on majority of insurance plans.

GST - Know about Goods and Services Tax in India with various types and benefits. Sir Please refer Blocked ITC list mentioned under sec 175 of CGST act 2017. Negative list of ITC that Input tax credit of GST paid on services of insurance servicing repair and maintenance of motor vehicles shall not be allowed.

Goods and Service Tax GST is an indirect tax which is applicable on the supply of goods and services. Input tax credit and output GST. Since GST is charged on both goods and services input credit can be availed on both goods and services except those which are on the exemptednegative list.

Section wise and Chapter wise. GST List of Zero-Rated Supply Exempted Supply and Relief. The Goods and Services Tax GST is an abolished value-added tax in Malaysia.

Blocked credit list Section 175 1. The process by which a taxpayer gets registered under Goods and Service Tax GST is GST registration. The items on which ITC cannot be availed must be recorded in the.

Section 175 of GST Act deals with the blocking of ITC on specified inward supplies. GST Act and Rules updated as on date. GST on different types of life insurance Policy-.

GST Margin Scheme for Second Hand Car Dealer in Malaysia. Refer Sales Brochure for. GST Input Tax Credit Refund Claiming.

Your input tax credits can also be blocked in future. Malaysia Tourist Refund Scheme. Malaysia GST Blocked Input Tax Credit.

Monthly GST Filing in Malaysia. The existing standard rate for GST effective from 1 April 2015 is 6. The Input tax credit cannot be obtained under this category.

Clarifications regarding applicability of GST and availability of ITC in respect of certain services. On such purchases he is liable to pay GST at a certain percentage say 18 ie. Say a business purchased the raw material for manufacturing its final product for Rs 100.

Input Tax Credit ITC on the GST Paid for Life Insurance. HSN stands for Harmonized system nomenclature it is a 6 digit uniform code that classifies 5000 products under GST. Q - What happens when the GST Form RFD-01 has some errors.

Goods And Services Tax GST Offences and Penalties in Malaysia. The tax was introduced as a replacement of all other forms of indirect tax like sales tax VAT etc. Rs 18 being known as tax paid on inputs or input tax.

Notifications issued for implementing the decisions of 40th GST Council Meeting Eighth Amendment 2020 to CGST Rules In wake of COVID pandemic date further extended till 31082020 for certain compliance under GST laws and till 30092020 for certain compliance Customs Central Excise and Service Tax Laws Removal of difficulty order issued. Manual filing and processing of refund claims in respect of zero-rated supplies. Refund of unutilized input tax credit of GST paid on inputs in respect of exporters of fabrics.

It is used for the systematic classification of products as well as facilitating international trade. By Kanika Sharma 197K Views November 30 2018 Introduction. October 5 2020 at 745 pm i have same questions.

Under Block Your Premium benefit the premium rate of the base death benefit will get blocked for a period of 5 years during which Life AssuredSpouse can request for increase in benefit amount up to 100 of the Sum assured chosen at policy inception. In case of discrepancies. This Page is BLOCKED as it is using Iframes.

Once the registration process has been completed the Goods and Service Tax Identification Number GSTIN is provided. Manner of distribution of credit by Input Service Distributor. Input tax is not.

However there are some goods and services on which ITC cannot be availed and is blocked which we discuss in this article. Hence there has been hike in the tax on Insurance services. Businesses are expected to file 2 monthly returns as well as an annual return.

GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer. Input tax credit is allowed on capital goods. ITC is used for payment of output tax.

ITC being the backbone of GST and there are many condition to claim ITC on any items. In this article we will discuss the List of HSN Code with Tax Rates. Ineligible Input Tax Credit ITC Under GST.

The Court To Allow An Input Tax Credit Canada Leyton

17 Faqs Related To Gst On Handicrafts Http Taxguru In Goods And Service Tax 17 Faqs Related To Gst On H Handicraft Goods And Services Goods And Service Tax

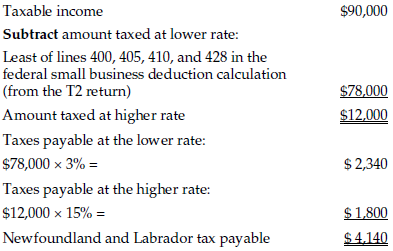

Dt Max Schedule 5 Tax Calculation Supplementary Corporations

Tax On Real Estate Sales In Canada Madan Cpa

Digital News Subscription Tax Credit 2022 Turbotax Canada Tips

Restaurants Can Not Claim Input Tax Credit र स तर ज एसट इनप ट ट क स क र ड ट क द व नह कर सकत Youtube

Ineligible Itc Under Gst Complete List With Example

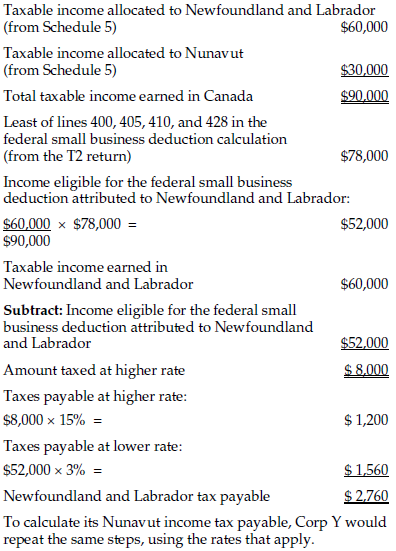

Dt Max Schedule 5 Tax Calculation Supplementary Corporations

Overview On Input Tax Credit Under Gst Law Passed On 27th March 2017 Http Taxguru In Goods And Service Tax Tax Credits Goods And Service Tax Corporate Law

Netfile Access Code Nac 2022 Turbotax Canada Tips

Gst Input Tax Credit On Supply Of Goods Or Services

Ineligible Itc Under Gst Complete List With Example

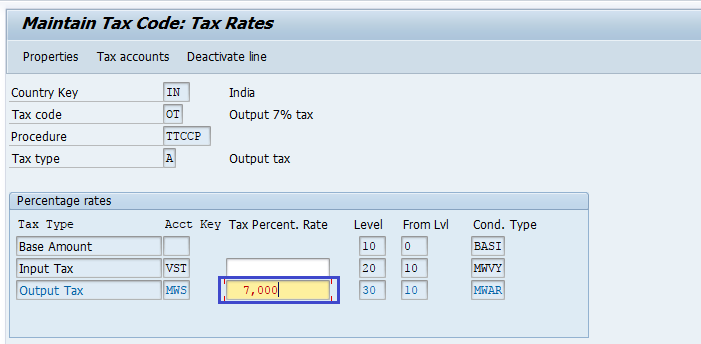

Sap Fico Maintain Tax Codes For Sales And Purchases

Ineligible Itc Under Gst Complete List With Example

Filling Out A Canadian Income Tax Form T1 General And Schedule 1 Using 2017 As An Example Youtube

Can I Claim The Gst Input Credit On The Gst That We Pay For A Luxury Car That I Buy In A Company S Name Quora